Lifestyle

5 Money Moves Nigerians Should Make Before 2025 Ends

As 2025 draws to a close, many people in Nigeria are under pressure. Prices of food items are rising, the naira is weak, school fees are coming, and December expenses are plenty: travel, weddings, parties, village trips, church and family support.....TAP TO CONTINUE READING

It is easy to say, “Let me just survive this December. I will plan my money next year.” But that is how the same money stress continues every year.

Now is actually a good time to pause and look at your money calmly. You don’t need to be rich or be a finance expert. You can still make some simple financial decisions before the year ends that will help you breathe better in 2026.

Here are 5 Money Moves Nigerians Should Make Before 2025 Ends:

1. Check and rebalance your investments

Rebalancing simply means “adjusting” your investments so that one part does not become too big and too risky. During the year, some things may have done very well, like dollar investments, some stocks or crypto. If you leave them to grow without control, they can become a large part of your total money. If those prices fall suddenly, your loss will also be very big.

Before the year ends, look at where your money is kept. If one area has grown a lot, you can sell a small part and move that money into safer places like treasury bills, government bonds, money market funds or other low-risk options.

This is very important if you are 50 years and above, because you are getting closer to the time when you will use that money for school fees, rent, hospital bills and feeding in retirement. At that stage, you need more peace of mind and less risk.

2. If you are still working, look at your retirement plan

If you are still working, this is a good time to check how ready you are for retirement. Start with your pension. Log into your pension account and see how much you have saved. Check if your employer has been paying regularly every month or if there are missing months. Many people only discover problems when it is already late.

Ask yourself if you can increase your pension contribution a little from next year, even if it is by a small amount. It can make a big difference over many years. If you are self-employed or running a small business and do not have any pension, think of joining a micro-pension plan or starting your own long-term investment, where you save every month in a mutual fund or fixed-income product. The goal is to make retirement saving a habit, not something you only do “when money comes.”

3. If you are retired, protect your monthly cash

If you have stopped working and now use your savings and investments to live, your main focus should be protecting your monthly income. Instead of taking money from your investments anyhow, try to do it in a planned way.

First, look at which investments went up the most this year. You can sell some of those and keep part of the money in very safe and easy-to-access places, like savings and money market funds. Try to build enough cash to cover at least six to twelve months of your normal expenses.

This way, you have money ready for your needs, you are not forced to sell risky investments when prices are low, and you sleep better at night. The older you are, the more important this is. Money you need soon should not be in something that can jump up and down every week.

4. Look again at your insurance before you renew

The end of the year is also a good time to check your insurance. Many Nigerians don’t have enough cover, or they are paying for plans that no longer fit their life.

Start with health insurance. Look at your current HMO plan. Ask yourself: Are you happy with the hospitals on the list? Is the care good enough? Does the plan cover the drugs and treatment you usually need? Has your family size changed this year? If your employer’s plan is weak, you may add a small private plan or upgrade if you can afford it.

Next, think about life insurance if people depend on your income. A simple life cover can help your family if anything happens to you. Check if your company or pension already includes life cover and if it is enough.

Also, check your car and home insurance. With the high cost of cars, building materials and repairs, paying for damage from your pocket can be very painful. Make sure your cover is up to date and still useful for your kind of car, house or shop. Don’t just renew last year’s policy without checking. Prices change, your life changes, and sometimes a better plan is available for the same or even lower cost.

5. Plan your December giving and charity

In Nigeria, December is full of giving. There is family pressure, village projects, church and mosque programmes, charity work and many personal requests. If you are not careful, you will give and give until you borrow for January rent and school fees.

Before that happens, sit down and decide how much you can give this December without going into debt or disturbing important bills next year. Write down that amount. After that, choose the people and causes that matter most to you. Maybe it is one relative who really needs help, a trusted charity, your place of worship or a community project you believe in.

It is better to give in a planned way than to give to everyone and later regret it. If you notice that you support the same charities or projects every year, you can also plan a smaller, regular amount every month in 2026 instead of one big, stressful payment in December. If your giving is large and you run a business, a tax or financial adviser can help you design a more organised way to do it.

Read The Full Article Here Now

👉 Are You A WhatsApp User? Do You Want To Get Our News As Fast As Possible On Daily Basis? 👉 Click This Link To Join WhatsApp Channel Now.

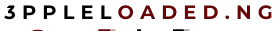

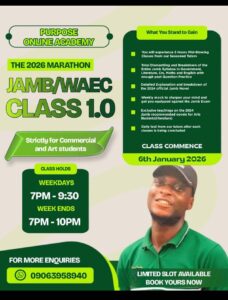

Art & Commercial students don’t fail JAMB because they’re dull. They fail because they’re taught like Science students. Science students calculate — JAMB rewards that. Art students explain — JAMB doesn’t. So you read hard, attend lessons, yet your score disappoints you. This online class fixes that. No theory overload. No confusion. Just real JAMB questions, clear breakdowns, and winning strategies. 📌 JAMB is not hard — you were just taught the wrong way.Click The Link To Reach Us Now 👉 https://wa.me/2349063958940

Lifestyle

Number Of Eggs Older people Should Eat Daily To Avoid Cholesterol Buildup

Discover the natural secret formula to make your manhood bigger, stronger, and longer, also ending premature ejaculation and infertility issues without side effects within a short period. Click here now.....TAP TO CONTINUE READING

Eggs are a nutritious food packed with protein, vitamins, and minerals, but they also contain cholesterol. For older adults, balancing egg consumption is important to maintain heart health and avoid cholesterol buildup.

Egg Consumption Guidelines for Older Adults

1. Moderation is Key

Studies suggest that 1 egg per day is safe for most healthy older adults. This amount provides essential nutrients without significantly raising blood cholesterol levels.

2. Consider Your Health Status

If you have high cholesterol, heart disease, or diabetes, limit egg yolks to 3–4 per week while enjoying egg whites more freely.

For healthy individuals, whole eggs can be eaten daily as part of a balanced diet.

3. Focus on How You Cook Eggs

Avoid frying eggs in excessive oil or butter.

Boiled, poached, or steamed eggs are healthier choices that reduce added fats.

4. Balance With Other Foods

Pair eggs with vegetables, whole grains, and healthy fats like avocado or olive oil.

Avoid pairing eggs with processed meats like bacon or sausages, which can increase cholesterol intake.

Why Eggs Are Beneficial

Eggs provide high-quality protein important for maintaining muscle mass, especially in older adults.

They contain choline, which supports brain and liver health.

They offer essential vitamins like B12, D, and selenium for overall wellbeing.

Conclusion:

For older adults, eating 1 egg per day is generally safe and provides numerous health benefits. Those with heart or cholesterol concerns should moderate yolk intake and focus on healthier cooking methods. By balancing egg consumption with a nutritious diet, older individuals can enjoy eggs without risking cholesterol buildup.

Read The Full Article Here Now

👉 Are You A WhatsApp User? Do You Want To Get Our News As Fast As Possible On Daily Basis? 👉 Click This Link To Join WhatsApp Channel Now.

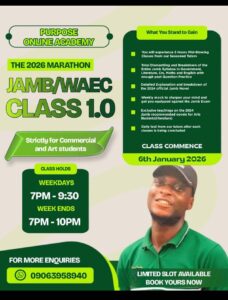

Art & Commercial students don’t fail JAMB because they’re dull. They fail because they’re taught like Science students. Science students calculate — JAMB rewards that. Art students explain — JAMB doesn’t. So you read hard, attend lessons, yet your score disappoints you. This online class fixes that. No theory overload. No confusion. Just real JAMB questions, clear breakdowns, and winning strategies. 📌 JAMB is not hard — you were just taught the wrong way.Click The Link To Reach Us Now 👉 https://wa.me/2349063958940

Lifestyle

Stop Excess Intake Of These 3 Types Of Food To Avoid Diabetes

Discover the natural secret formula to make your manhood bigger, stronger, and longer, also ending premature ejaculation and infertility issues without side effects within a short period. Click here now.....TAP TO CONTINUE READING

Diabetes is one of the main causes of death worldwide, and it has already claimed the lives of several persons who jogged at regular rates while living in the wild, according to the World Health Organization (WHO).

Types 1 and 2 diabetes are the two main varieties that affect people.

The pancreas’ capacity to make insulin is chronically insufficient in those with type 1 diabetes…Read More…>>>

This disorder is brought on by inadequate type 2 insulin sensitivity.

Medical organizations have identified diabetes as a stressor since it is an innate reaction to the meals we consume. This suggests that, occasionally, we may have some responsibility for our own worries.

The following three foods can be consumed less frequently to lower the chance of developing diabetes:

wholesome carbs

In addition to assisting the body in generating energy and preserving existing tissue, carbohydrates have several positive effects on health. The risk of getting diabetes is increased by regularly ingesting a wide variety of sugary meals.

Beverages with added sugar: you ingest additional sugar into your diabetic body every day without even thinking about it.

Red and processed meats should be avoided after the age of 40 by responsible adults due to their detrimental health consequences.

These three food types, according to the website Fleekloaded.com, make up an unhealthy diet that can result in diabetes, which can be fatal.

Read The Full Article Here Now

👉 Are You A WhatsApp User? Do You Want To Get Our News As Fast As Possible On Daily Basis? 👉 Click This Link To Join WhatsApp Channel Now.

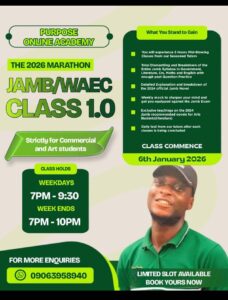

Art & Commercial students don’t fail JAMB because they’re dull. They fail because they’re taught like Science students. Science students calculate — JAMB rewards that. Art students explain — JAMB doesn’t. So you read hard, attend lessons, yet your score disappoints you. This online class fixes that. No theory overload. No confusion. Just real JAMB questions, clear breakdowns, and winning strategies. 📌 JAMB is not hard — you were just taught the wrong way.Click The Link To Reach Us Now 👉 https://wa.me/2349063958940

Lifestyle

Never Eat Cabbage if You Have Any of These 6 Health Problems

Cabbage is a healthy vegetable rich in vitamins, minerals, and fiber. However, it may not be suitable for everyone. In some health conditions, eating cabbage can worsen symptoms or affect treatment. Below are health problems where cabbage intake should be reduced or avoided.....TAP TO CONTINUE READING

Thyroid problems such as goiter and hypothyroidism

Cabbage contains goitrogens that can interfere with thyroid hormone production. Eating too much, especially raw cabbage, may enlarge the thyroid gland or worsen hypothyroidism.

People with thyroid conditions should limit raw cabbage intake.

Irritable bowel syndrome or chronic bloating

Cabbage is high in fiber and fermentable carbohydrates that can cause gas and bloating. For people with IBS, this may trigger stomach pain, cramps, and diarrhea.

Kidney problems

Cabbage contains a high level of potassium, which may be unsafe for people with kidney disease. If the kidneys cannot properly remove potassium, it can lead to dangerous heart rhythm problems.

Blood clotting disorders

Cabbage is rich in vitamin K, which supports blood clotting. People taking blood-thinning medications such as warfarin may experience reduced drug effectiveness if they consume too much cabbage.

Acid reflux or heartburn

Some individuals may notice increased acid reflux or heartburn after eating cabbage, especially when it is raw. It can raise stomach acid levels and cause discomfort.

Post-surgery digestive recovery

After abdominal or digestive surgery, cabbage can cause gas and bloating, which may slow healing. Doctors often advise avoiding gas-producing vegetables like cabbage during recovery.

Read The Full Article Here Now

👉 Are You A WhatsApp User? Do You Want To Get Our News As Fast As Possible On Daily Basis? 👉 Click This Link To Join WhatsApp Channel Now.

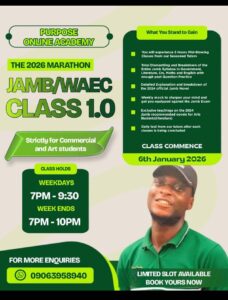

Art & Commercial students don’t fail JAMB because they’re dull. They fail because they’re taught like Science students. Science students calculate — JAMB rewards that. Art students explain — JAMB doesn’t. So you read hard, attend lessons, yet your score disappoints you. This online class fixes that. No theory overload. No confusion. Just real JAMB questions, clear breakdowns, and winning strategies. 📌 JAMB is not hard — you were just taught the wrong way.Click The Link To Reach Us Now 👉 https://wa.me/2349063958940

-

Breaking News5 months ago

Breaking News5 months agoWorld’s Youngest Undergraduate is Nigerian JOSHUA BECKFORD, gained admission in Oxford University at the age of Six years

-

Breaking News3 months ago

Breaking News3 months agoJUST IN: Finally United States President Donald Trump Revokes 80,000 Visas of Nigerians, Other Foreign Nationals

-

Breaking News5 months ago

Breaking News5 months agoBREAKING NEWS: Woman in Trouble For Burning 7-year-old Girl’s Private Parts With Hot Knife

-

Breaking News5 months ago

Breaking News5 months agoBREAKING NEWS: FULL DETAILS! Top Secret Leaked Why SIM Fubara Fails to Return to Government House After Reinstatement

-

Breaking News3 months ago

Breaking News3 months agoBREAKING NEWS: Nigerian Billionaire Lawmaker Ned Nwoko, Orders Arrest of His Mother In Law Regina Daniels’ Mother, Rita

-

Breaking News5 months ago

Breaking News5 months agoBREAKING NEWS: Federal Government Releases Proof of N25,000 Cash Transfers to 71 Million Nigerians in 8.1 Million Households

-

Breaking News5 months ago

Breaking News5 months agoBREAKING NEWS: Another Rivers Saga: Just Reinstated Fubara Told to Sack All Sole Administrators Appointees, Seek Tinubu’s Assurance Over Impeachment

-

Breaking News5 months ago

Breaking News5 months agoBREAKING NEWS: Finally Department of State Services (DSS) summons Sowore over post on Tinubu